Hourly wage calculator by state

Make sure you account for all applicable local and state taxes imposed on labor. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck recalculate monthly wage to hourly rate weekly rate to a yearly wage etc.

Paycheck Calculator Take Home Pay Calculator

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. No state minimum wage law. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

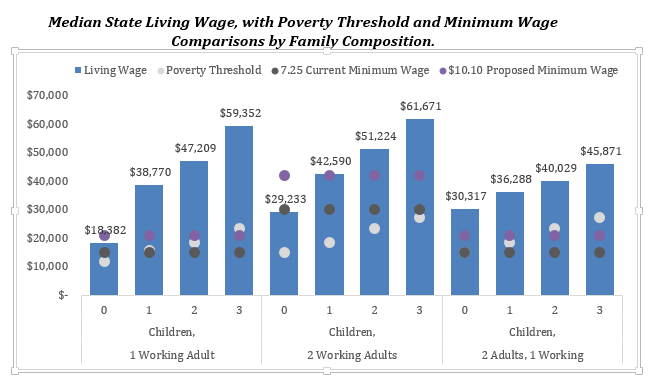

State minimum wages are determined based on the posted value of the minimum wage as of January one of the coming year National Conference of State Legislatures 2019. Metropolitan and nonmetropolitan area National. Fast food industry workers in NYC - 1500.

For example California has the additional requirement that contractors register with the state. The latest budget information from April 2022 is used to show you exactly what you need to know. Heres a step-by-step guide to walk you through the tool.

Hourly to Salary Conversion Calculator. 10 Average Salaries by State as an Oncology Nurse. This calculator can convert a stated wage into the following common periodic terms.

Fill in the employees details This includes just. You can easily check your city another state nearby countries or even another. The poverty rate reflects a persons gross annual income.

Rates will increase each year until they reach 1500 per hour. Hourly weekly biweekly semi-monthly monthly quarterly and annually. As with the federal laws states with prevailing wage laws only apply to construction and to specific occupations.

When using this hourly to salary calculator to learn how much your hourly rate is as an yearly salary you should always consider the difference between pre-tax and after-tax salary and hence - hourly. To convert your hourly wage to its equivalent salary use our calculator below. State prevailing wage laws vary in their requirements.

Enter the number of hours you work a week and click on Convert Wage. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

Bureau of Labor Statistics Division of Occupational Employment and Wage Statistics PSB Suite 2135 2 Massachusetts Avenue NE Washington DC 20212-0001. Employers are required provided certain conditions are. Has variable minimum wage levels.

Maryland includes state-funded businesses not just construction projects. CPI Inflation Calculator. Minimum wage rates differ based on industry and region.

Updated March 18 2021 Published November 6 2020. Salary to hourly wage calculator lets you see how much you earn over different periods. Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweekIssuing comp time in place of overtime pay is not allowed for non-exempt employees.

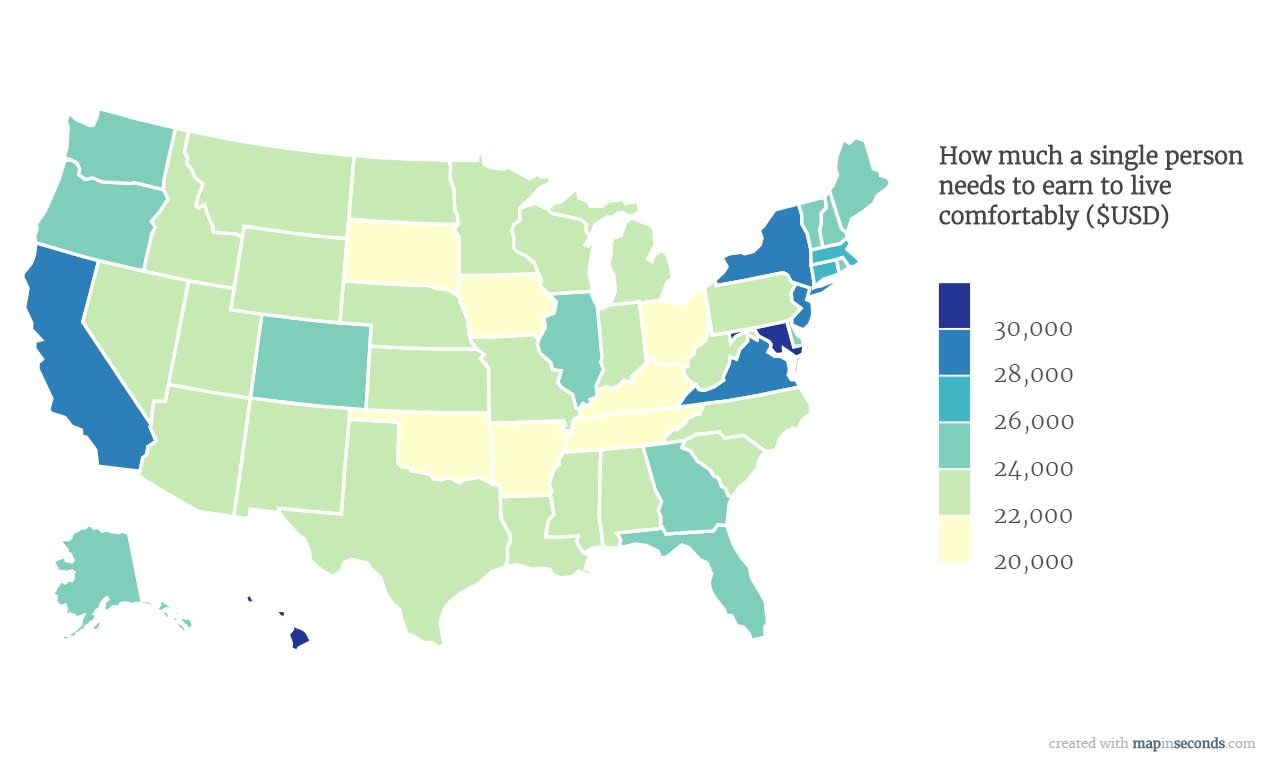

Hourly rates weekly pay and bonuses are also catered for. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll.

First enter the dollar amount of the wage you wish to convert as well as the period of time that the wage represents. The Minimum Wage Act Article 19 of the New York State Labor Law requires that all employees in New York State receive at least 1320 an hour beginning December 31 2021. Injury and Illness Calculator.

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to salary calculator. Hourly to Salary Conversion Calculator.

By Indeed Editorial Team. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Employers must provide an employee with 24 hours written notice before a wage change.

825 no insurance725 with insurance. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

Paycheck Calculator Take Home Pay Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

Real Hourly Wage Calculator To Calculate Work Hour Net Profit

Hourly To Salary What Is My Annual Income

This Map Shows The Living Wage For A Single Person Across America

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Chart The Living Wage Gap Statista

Mit Living Wage Calculator Why Higher Wages Help Everybody Alum Mit Edu

Salary To Hourly Salary Converter Salary Hour Calculators

Hourly To Salary Wage Calculator Salary Calculator

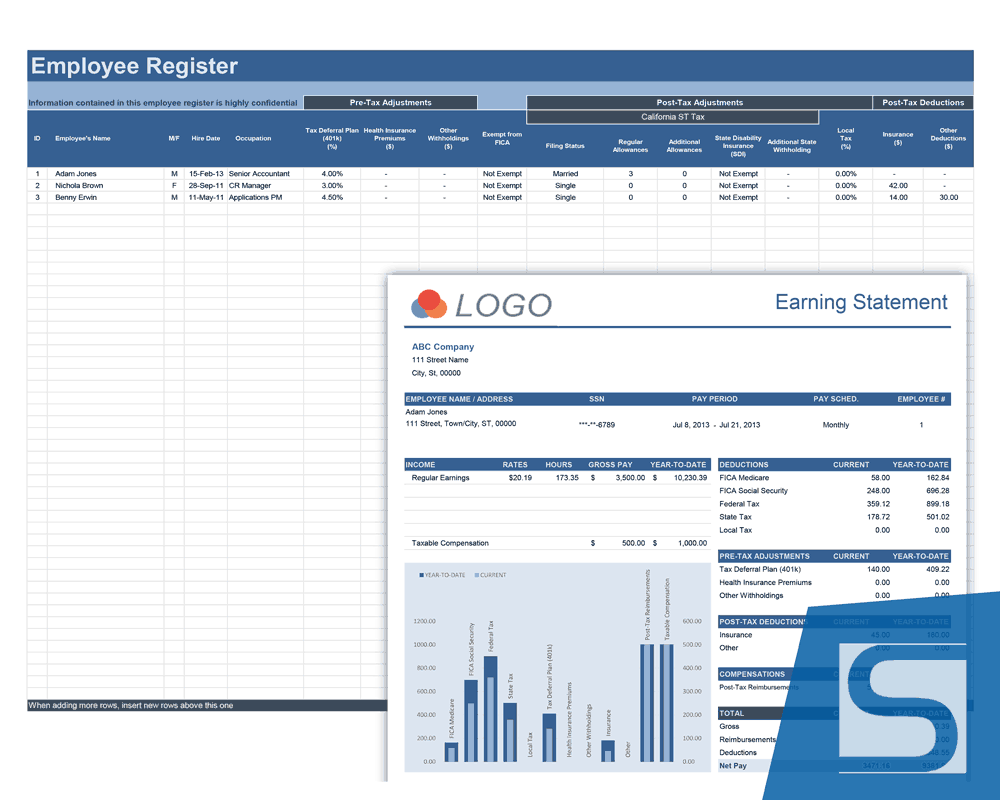

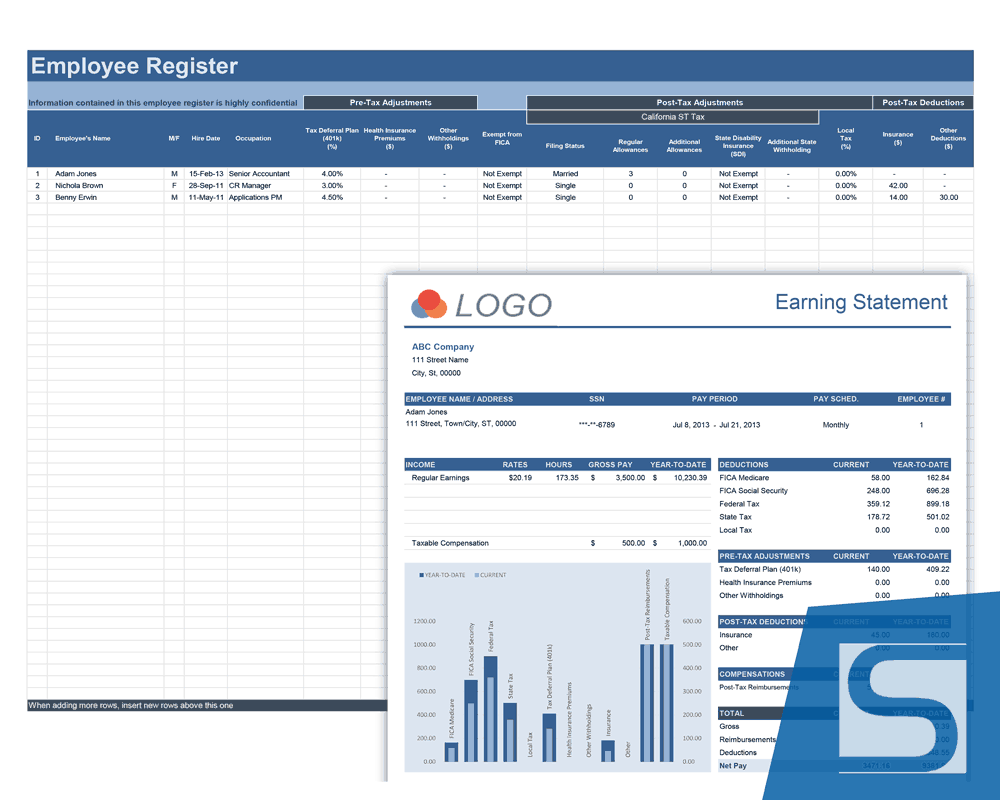

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Are You Ready To Calculate Your Real Hourly Wage Google Sheet

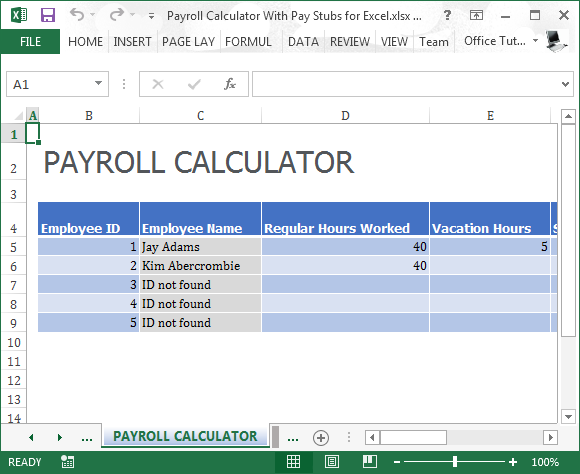

Payroll Calculator With Pay Stubs For Excel

Hourly To Salary Pay Calculator

Hourly To Salary Calculator Convert Hourly Wage To A Salary